In Applying the High Low Method Which Months Are Relevant

In applying the high-low method which months are relevant. Calibration verification is required by CLIA but why else is it.

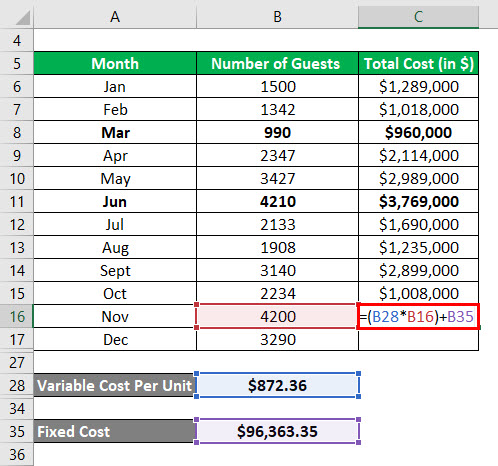

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

In applying the high-low method what is the unit variable cost.

. Month Miles Total Cost January 80000 192000 February 50000 160000 March 70000 188000 April 90000 260000 a. In applying the high-low method which months are relevant. When it comes to cost accounting the high-low method is an approach thats used to break mixed costs into either a variable or fixed cost.

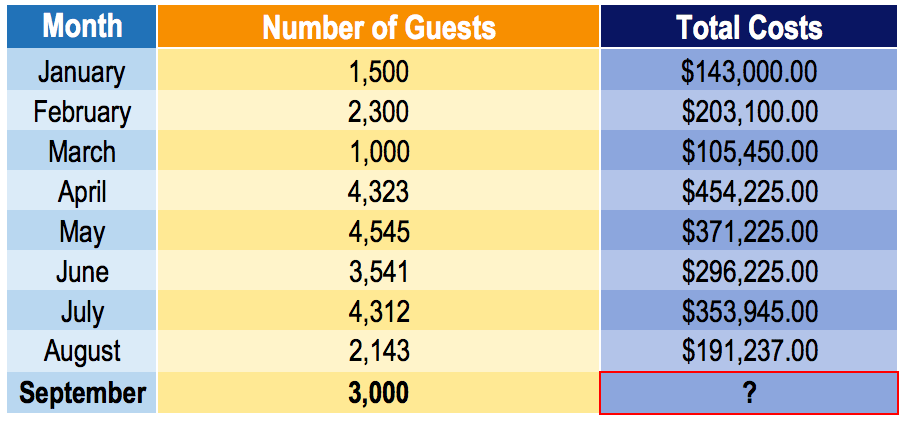

Using either the high or low activity cost should yield approximately the same fixed cost value. So the highest activity happened in the month of April and the lowest is in the month of October. Given a set of data pairs of activity levels ie.

At the high level of activity in November 7000 machine hours were run and power costs were 16000. Because 8000 and 11000 units are both above the level at which fixed costs increase you first use the high low method on these two. In cost accounting the high-low method refers to the mathematical technique that is used to separate fixed and variable components that are otherwise part of the historical cost that is mixed in nature ie partially fixed and partially variable.

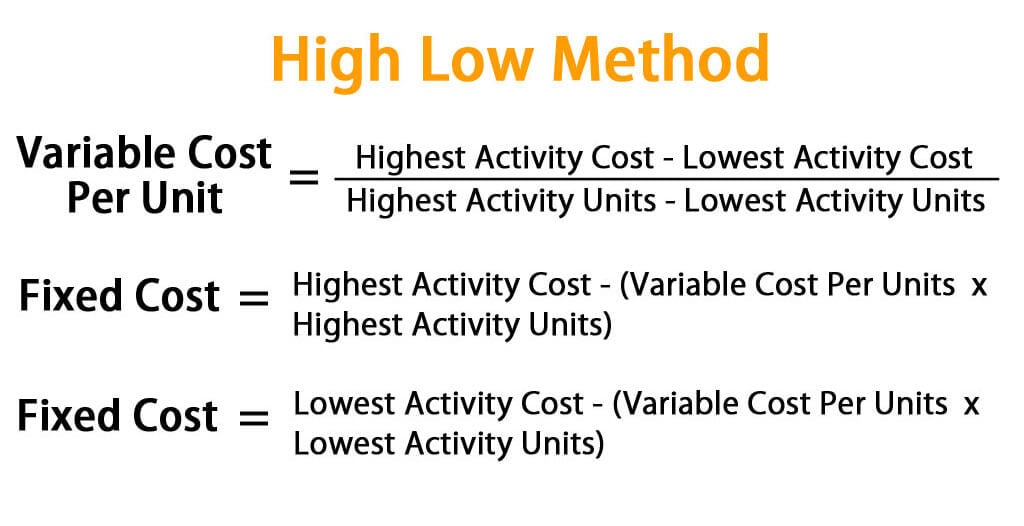

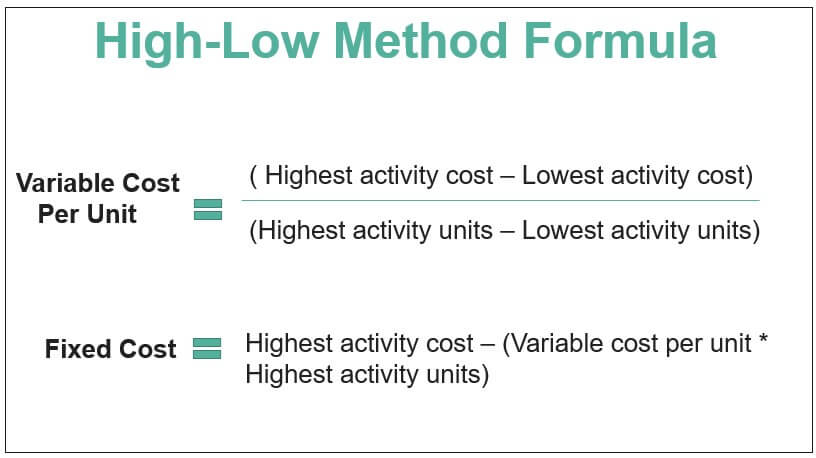

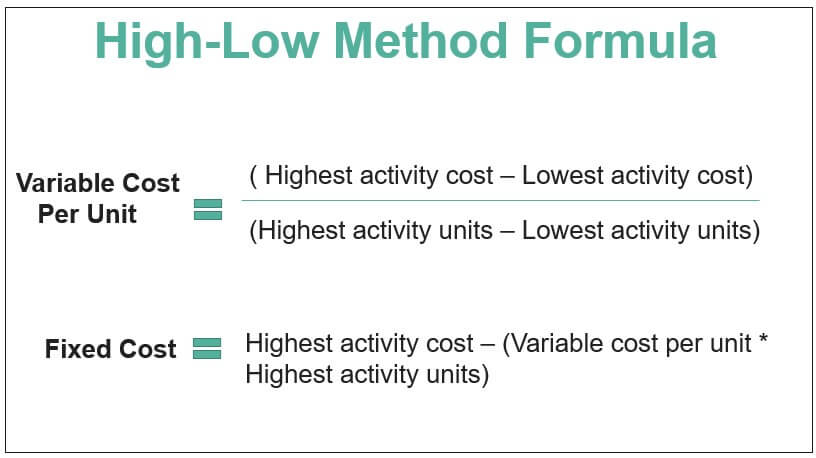

Using the high-low method the estimated fixed cost element of power costs is a. High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components. Fixed cost Total cost at activity level - Total variable cost.

Therefore variable cost per unit is 1875computed as follows. Accounting questions and answers. It is important to remember here that it is the highest and lowest activity levels that need to be identified first rather than the highestlowest cost.

To solve this using the high-low method formula subtract the lower cost from the higher cost to get a numerator of 27675 then subtract the lowest number of units from the highest quantity to. Fixed cost 105450 7497 x 1000 30480. Month Miles Total Cost January 80000 192000 February 50000 160000 March 70000 188000 April 90000 260000 February and April January and April January and February February and March.

Determine the highest and lowest activity point. It is important to ensure that samples of the appropriate matrix are used. The Flexible Method Percent Over n Months Prior is similar to Method 1 Percent Over Last Year.

The costs at these two levels are 195000 and 120000 re-spectively. Popular Course in this category. In cost accounting a way of attempting to separate out fixed and variable costs given a limited amount of data.

So at 7000 units the variable cost will still be 12 per unit. It is used to observe changes in the dependent variable. January and February b.

These are then used to. Illustration - Applying the high low method. 1 Approved Answer BASANT S answered on June 12 2021 5 Ratings 17 Votes February and April months are relevant in high and low method Two quantities are important higher quantities and lower quantities.

It takes the highest and lowest activity levels and compares their total costs. Solution pdf Do you need an answer to a question different from the above. February and March QUESTION 7 10 points Save.

January and April c. Month Miles Total Cost January 80000 144000 February 50000 120000 March 70000 141000 April 90000 195000 a. Month Miles Total Cost January 80000 96000 February 50000 80000 March 70000 94000 April 90000 130000 January and February January and April February and April d.

This quiz has been formulated to give you the chance to practice. The difference in costs is 75000 195000-120000 and the difference in miles is 40000 90000-50000. In the Percent Over Last Year method the projection is based on data from the same time period in the previous.

February and April d. Although its straightforward its important to do multiple analyses because outlier costs from the available data can sometimes misconstrue operating costs. Now you want to use a high low method to segregate fixed and variable cost.

Re-calibration of a test more frequently than every 6 months meets calibration verification requirements if the calibration includes samples with low mid and high values near the AMR. It is a nominal difference and choosing either fixed cost for our cost model will suffice. This calculation occurs by looking at the periods with the most.

The high and low levels of activity are 90000 miles in April and 50000 miles in February. Labor hours machine hours etc and the corresponding total cost figures high-low method only takes two extreme data pairs as inputs. Both methods multiply sales data from a previous time period by a factor specified by you and then project that result into the future.

The high low method uses a small amount of data to separate fixed and variable costs. On the other hand regression analysis shows the relationship between two or more variables. Reading comprehension - ensure that you draw the most important information from the.

Identify the highest and lowest activities. Calculate the fixed cost by substitution using either the high or low activity level. April Industries sells a product with a contribution margin of 12 per unit fixed costs of 223200 and sales for the current year of 300000.

QUESTION 6 10 points Save Answer In applying the high-low method which months are relevant. This gives a variable cost of 12 per unit and a fixed cost of 144000. In applying the high-low method which months are relevant.

In April a month of low activity 2000 machine hours were run and power costs amounted to 8000. Use the total fixed cost and the variable cost per unit values steps 2 and 3 to calculate the estimated cost at different activity levels. The high-low method comprises the highest and the lowest level of activity and comparison of the.

Month Miles Total Cost January 80000 192000 February 50000 160000 March 70000 188000 April 90000 260000. The high-low method involves taking the highest level of activity. Lowest activity level is 4000 units in March.

Note that our fixed cost differs by 635 depending on whether we use the high or low activity cost. April month have higher quantities of both. Highest activity level is 6000 units in Jan.

High Low Method In Accounting Definition Formula

High Low Method Learn How To Create A High Low Cost Model

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Comments

Post a Comment